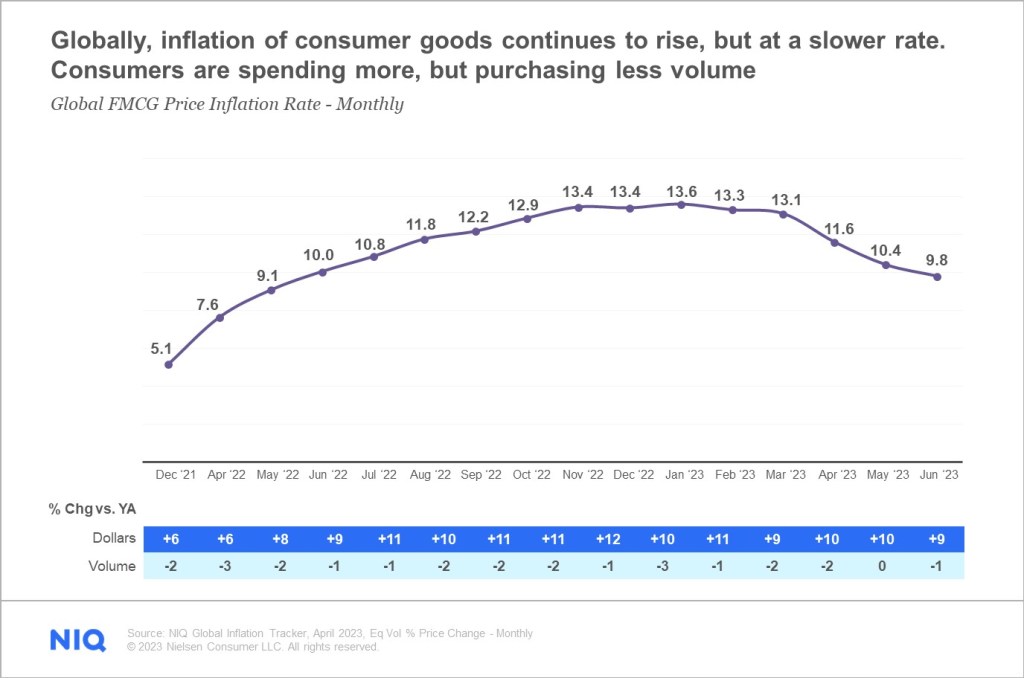

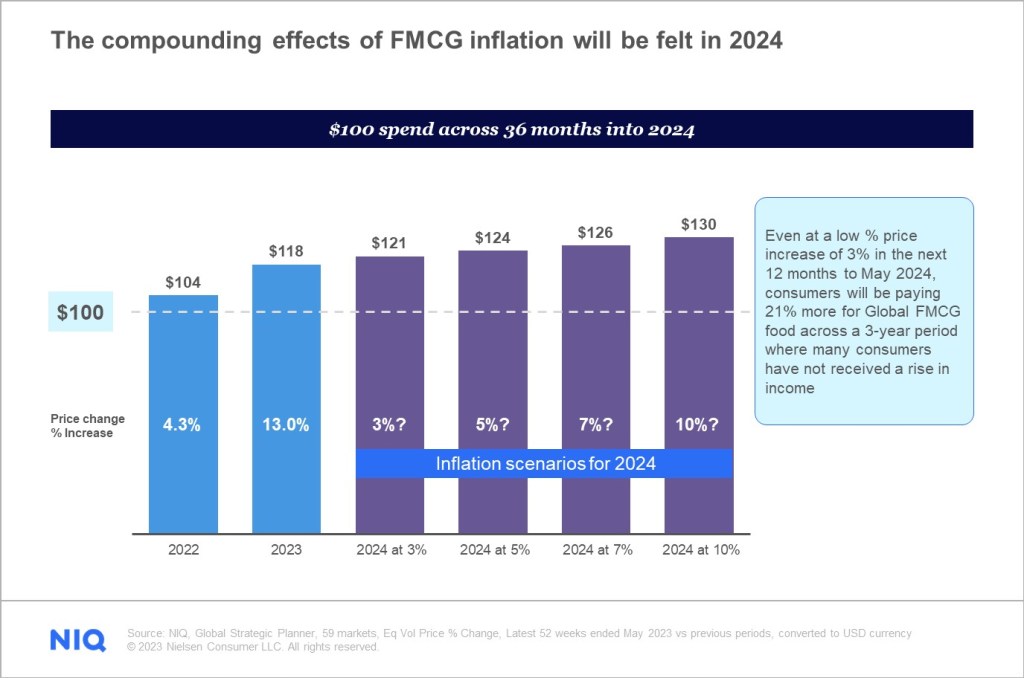

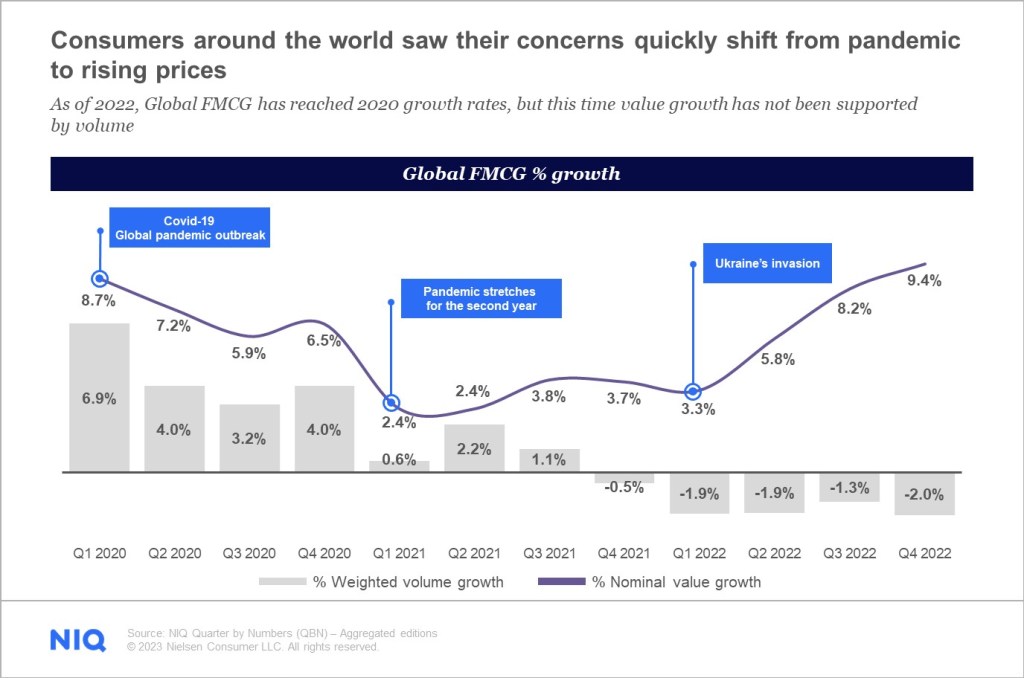

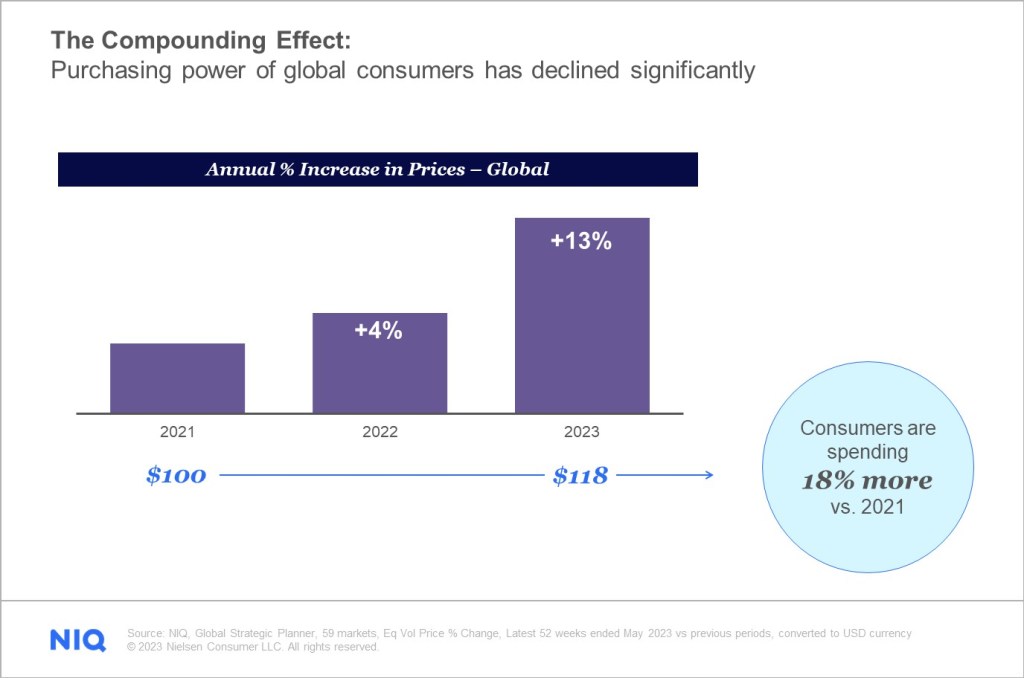

2024 Consumer Trends Graph – What’s Next? Introduction Consumer banking, once a bastion of traditional brick-and-mortar institutions, is undergoing a seismic shift driven by technological advancements and changing consumer . If we compare prices in December 2023 to January 2020, overall prices are up 19%, food prices are up 25%, energy prices are up 26%, and the prices of shelter services .

2024 Consumer Trends Graph

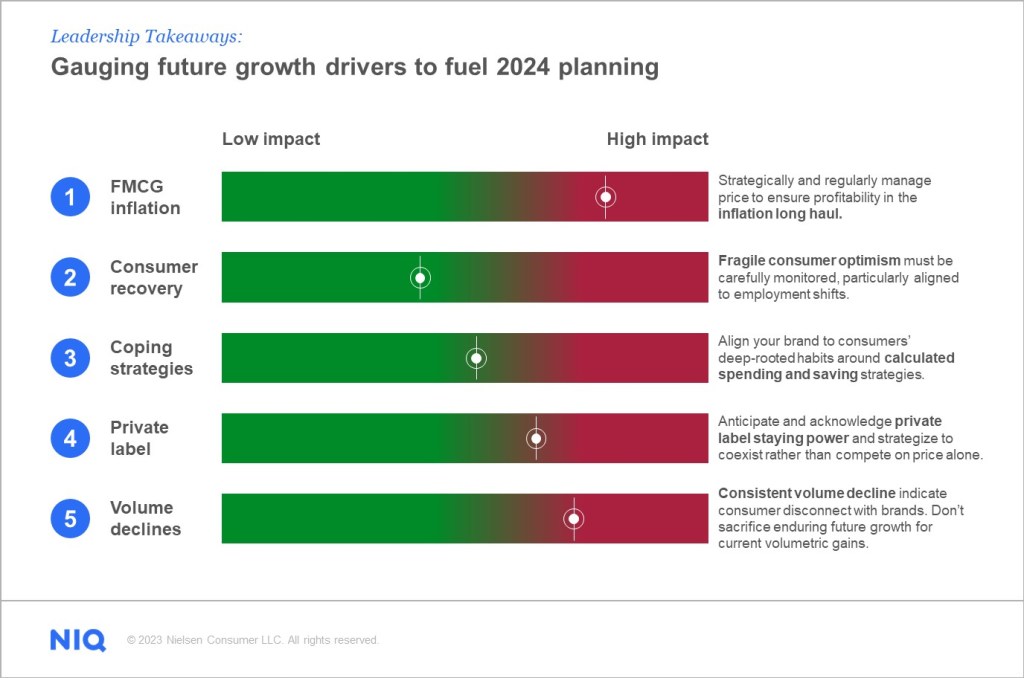

Source : nielseniq.comWhat retailers need to know about 2024 (and beyond) in 5 charts

Source : www.insiderintelligence.comThe ‘Cost of Living’ Catalyst: Top 5 Consumer Trends to Monitor

Source : nielseniq.comThe Biggest Consumer Trends For 2024

Source : blog.gwi.comThe ‘Cost of Living’ Catalyst: Top 5 Consumer Trends to Monitor

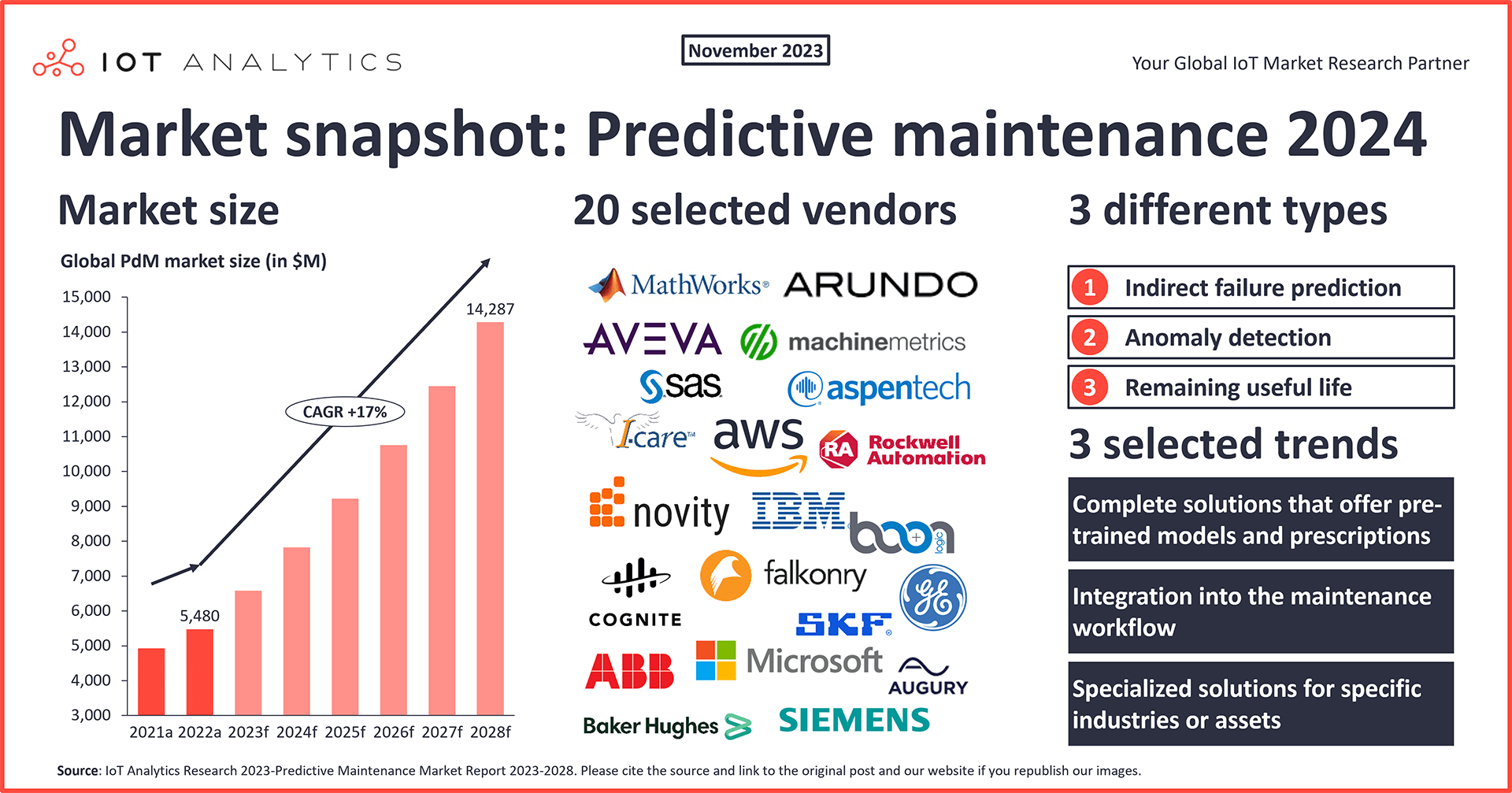

Source : nielseniq.comPredictive maintenance market: 5 highlights for 2024 and beyond

Source : iot-analytics.comThe ‘Cost of Living’ Catalyst: Top 5 Consumer Trends to Monitor

Source : nielseniq.comData Visualization Tools Market 2023: Focusing on Latest

Source : www.linkedin.comThe ‘Cost of Living’ Catalyst: Top 5 Consumer Trends to Monitor

Source : nielseniq.comFive Trends That Will Make or Break the 2024 Labor Market

Source : www.indeed.com2024 Consumer Trends Graph The ‘Cost of Living’ Catalyst: Top 5 Consumer Trends to Monitor : Many banks have already signed up for FedNow, but some of the largest players have yet to do so. But as more banks adopt the service, more consumers will be able to both access their money faster and . graph showing history balances grew for most types of consumer debt in 2023. Credit cards—the debt products with the highest average interest rates for consumers—grew the most. The only category .

]]>